|

We Still Live in a World of Earnings-Based Investment

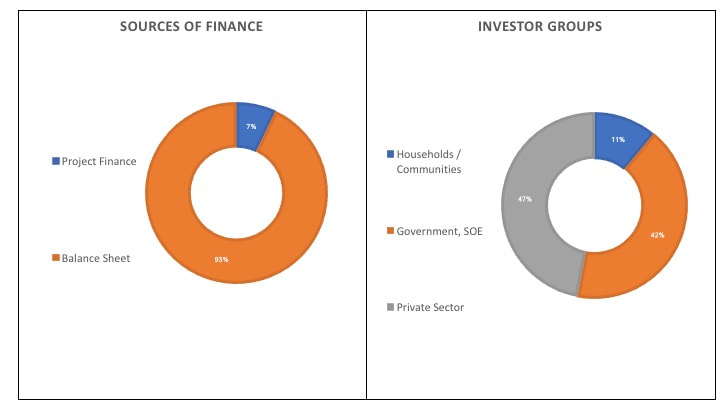

According to a recent report by the International Energy Agency, the large majority of energy investment remains financed from the balance sheets of investors. The proportion of balance sheet investing has remained relatively constant during recent years. However, project finance, as a strategy to move investments off the balance sheet and to rely on cash flows for asset valuation, has grown by 50% over the past five years. Most of this growth has come from renewable generation investment, in emerging economies. This trend reflects a growing confidence in project development in these countries, and lower risk profiles associated with maturing technologies. Increasingly, new sources of funding are becoming available as well, notably green bonds, and project bonds; these have allowed investors and developers to tap larger pools of resources to move projects forward. (IEA, World Energy Investment 2017, https://www.iea.org/publications/wei2017/) Sources of Finance for the USD 1.7 Trillion in 2016 Energy Investments

2 Comments

Sam Aman

1/8/2019 12:18:41 pm

Green Bonds is a great idea to explore for this newly emerged industry as a necessity shift for sustainable development for emerging economies.

Reply

Leave a Reply. |

Richard Swanson, Ph.D.Asset valuation and project finance expert, specializing in financial and economic analysis of civil infrastructure assets. Archives

June 2022

Categories |

RSS Feed

RSS Feed